Transforming Communications Through Storytelling

Transforming executive communications through customer-centric storytelling and interactive design.

Measurable impact

Strategic design decisions that drove enterprise-wide transformation

Financial services organizations require more than traditional presentations to communicate their complex offerings effectively; they need immersive, story-driven experiences that demonstrate tangible customer impact. This case study examines the transformation of Synchrony Financial's board communications through an interactive "day-in-the-life" experience. Resulting in enhanced executive engagement and organizational adoption, this solution prioritized customer-centric storytelling while showcasing comprehensive service integration.

Executive Communication Design Challenge.

This project reimagined how financial services companies present complex offerings to leadership through interactive, customer-focused storytelling experiences.

Transforming Traditional Executive Presentations

How can we transform traditional board presentations into engaging, interactive experiences that demonstrate Synchrony's comprehensive service integration across diverse customer life cycles?

Synchrony Financial, the largest provider of private-label credit cards in the United States, faced a challenge in effectively communicating its comprehensive suite of financial services to its board members. With multiple business units serving customers across various life stages, the company struggled with traditional linear presentations that failed to capture the interconnected nature of their customer relationships.

However, Synchrony was missing opportunities to demonstrate the real-world impact of its customer-first approach. How can we design an engaging presentation format that enables executives to grasp complex service ecosystems while maintaining a focus on authentic customer experiences?

Interactive Family Journey Experience

An interactive "Experience Journeys" presentation follows a multi-generational family through a single day, showcasing how Synchrony's services seamlessly integrate into customers' daily financial routines while allowing executives to explore content at their own pace.

Service Design Blueprint

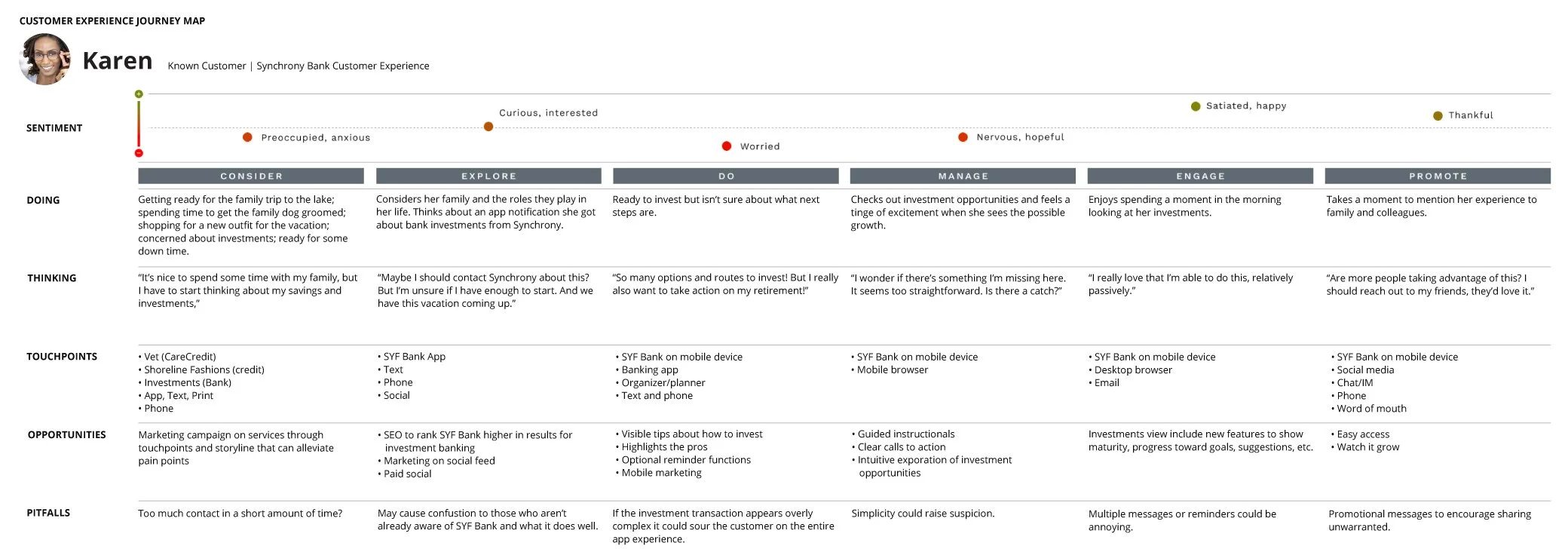

I created comprehensive experience blueprints to map customer touchpoints across Synchrony's service ecosystem and identify natural integration opportunities. This revealed that both front-stage customer interactions and backstage business processes are needed to support cohesive storytelling.

Persona Architecture Development

I developed detailed multi-generational family personas to represent Synchrony's diverse customer base throughout different life stages. Executives typically focused on individual business units—we needed to create characters that could demonstrate cross-service integration naturally.

Wireframing & Prototyping

Starting with story mapping helped reveal narrative opportunities and service integration points before moving to high-fidelity interactive prototypes that maintained executive attention while delivering comprehensive information.

Four Core System Features

Narrative-Driven Structure: Multi-generational family story demonstrating natural service integration

Interactive Exploration System: Self-paced navigation allowing deep-dives into relevant business areas

Cross-Integrated Content: Seamless connections between individual services and broader business strategies

Visual Storytelling Framework: Custom illustrations and clear user flows making complex financial concepts accessible

Impact & Success Metrics

The solution successfully transformed traditional board communications while maintaining the comprehensive information delivery that executives require. The interactive experience offers intuitive mechanisms for board members to access relevant content as they naturally explore.

Quantitative Results

Qualitative Impact

What I Learned

This project reinforced the importance of customer-centric storytelling in executive communications. By prioritizing authentic customer experiences over feature presentations, we created a format that not only improved engagement but also significantly enhanced strategic understanding. The key was recognizing that executives don't just need comprehensive information—they need contextual frameworks that support effective decision-making.

The success stemmed from treating the presentation as an experience design challenge rather than a traditional communication task. Rather than forcing linear consumption, we created tools that adapted to each executive's exploration preferences and information needs.